Improving eGrocery margins as growth is turbo-charged

Cracking the eGrocery market can be tough.

Humans are creatures of habit, and supermarket shopping data provides more than enough evidence to back this up. The weekly cycle of food shopping is so ingrained in everyone’s lives, with patterns not just emerging in the regular, repeat shopping lists but the times they like to shop, the seasonal variance in their diets and the best time to offer them a discount on a bottle of wine.

That is, of course, until life changing moments occur and regular routines get interrupted. This is when people become susceptible to a change in habit, either planned or forced. Target, for example, famously identified the exact date for one of the most significant disruptive moments in people’s lives - the moment they get pregnant - and was able to build a very successful big data marketing strategy off the back of its research.

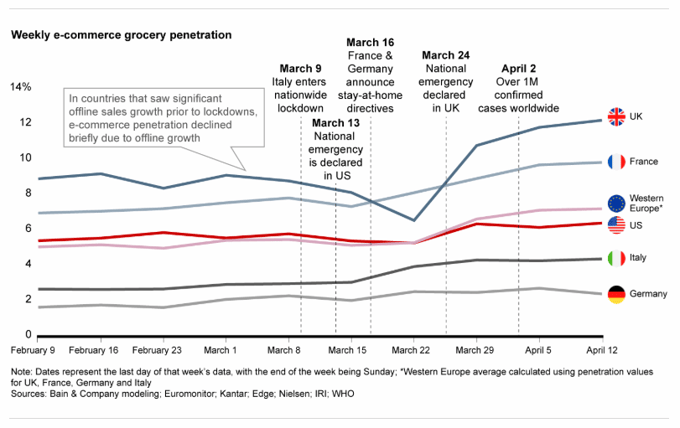

More recently, however, an even greater and widespread change in habits emerged with local lockdowns enforced around the world in the fight against COVID-19. Suddenly housebound, grocery customers needed to adapt their buying behaviours and created a massive surge in eGrocery orders.

While online grocery shopping has been around for nearly 20 years, COVID-19 radically accelerated the digital transformation in the space of a few months. This is according to some fascinating research and recommendations on how to ramp up your eGrocery business - without breaking the bank - from Bain & Company. It forecasts that online grocery trading could as much as double in select markets over the next five years.

35 percent of the COVID-related spending surge is expected to be sustained in Italy after the pandemic, the report estimates, with 40 percent in the US and France, and 45 percent in the UK and Germany. Across these markets it is estimated that there will be 350 million more online grocery orders in 2020 than there were in 2019, a swell of about $36 billion year on year.

However, with this turbo-charged growth also comes a warning that the speed of this unexpected acceleration could actually have a negative impact on retailer profits if no action is taken to improve the economic viability of the channel. Ramping up eGrocery services to meet the new levels of demand with sustainable growth, it says, requires robust digital infrastructure. Without it, profits could quickly be diluted.

It suggests three strategies; optimising the omnichannel network, diversifying revenue streams, and removing unsustainable channel subsidies.

Omnichannel networks

Making the transition from a high street grocery store to an omnichannel operator - with both eGrocery and instore offerings - is now more straightforward than ever with headless commerce solutions. ‘Headless’ means that the back-end of an e-commerce application can be treated separately to the front-end of the website. This separation allows APIs and microservices to be easily integrated with a website’s front-end design to deliver all aspects of the online shopping process, from the shopping cart to the checkout.

These cloud-native microservices extend to provide assistance in streamlining the management of product data, linking products to the site content for marketing purposes and the management of online order fulfilment, including pick-pack-ship and payment.

While the efficiencies in set-up and ongoing management afforded by these software solutions can provide grocery traders with a solid foundation on which to develop an online channel, it is the order management system (OMS) that can play the biggest role in optimising across omnichannel. Streamlining the process of order to fulfilment through an omnichannel approach is one of the most effective ways to save margins.

Bain & Company highlight a couple of different options for this, including rethinking a physical store network to create dark stores (see our dark stores blog here), as adopted by Whole Foods and Kroger, or opening automated fulfilment centres that use robotic picking, as seen at Ocado.

Of course, the capital expenditure required to adopt the advanced robotic technologies of these centres does make them beyond reach for huge numbers of small to medium sized grocers. Contrary to the reported margins in Bain & Company’s analysis, however, the efficiencies that can be gained by leveraging headless commerce solutions to streamline order fulfilment in fact do make in-store picking a viable option that protects profits for all grocers.

For example, Emporix’s wave-picking solution will combine all picked items into an order cycle to streamline the process, meaning that grocery retailers can manage their own systems, gain from the centralised efficiencies and keep hold of the profits rather than lose them to a third party.

Diversify revenue streams

Another great opportunity for online grocery retailers is to leverage their platform with new marketing strategies. Brand activation campaigns, vendor-branded collaborations, packaged data services, content marketing and digital advertising are all possibilities with an online shop. Again, cloud-based microservices (like Emporix's partner, Voucherify) offer the ability to integrate content management systems that will directly link products to specific promotions with ease. This allows retailers to introduce all kinds of new promotional tactics to encourage upspend and cross-selling via their digital store.

Take Tmall in China as a leading example of what the future of online retail in the West will look like in terms of marketing. With over 700 million Chinese consumers on its platform and an average of eight visits per consumer a day, Tmall is more than just a place to sell products online, it is the biggest marketing platform in China. Brands share their stories and content, videos, competitions, live streaming and much more on the platform, making it a go to place for consumers to engage with brands.

Bain & Company estimate that creating diversified revenue streams such as this, while still maintaining traditional trade terms, could add up to six percent to a grocer’s online operating margin.

Remove unsustainable channel subsidies

The third of the suggested strategies from Bain & Company encourages retailers to review their online pricing strategies, which could improve margins by up to 15-20 percent.

Just as consumers have needed to adapt their own behaviours and are more open to change in this current climate, now may also be the best time to bring charging models more in line with the cost of services. Variations on delivery times, minimum orders or subscription fees offer good options, while new fee structures can be tested and refined with small pools of customers before any larger scale launch. Again, an agile headless commerce solution provides the best way of integrating tailored pricing strategies for different stores, as we have recently assisted MPREIS in achieving across its Austrian grocery stores with its new digital storefront.

The market is moving fast, so creating the right digital infrastructure with headless commerce software based on cloud-based microservices and APIs is now more pressing than ever. As we have seen, the rewards can be huge for the right eGrocery approach.

To find out how Emporix can help you, get in touch here.